News

July 2024 CPI Report | CEA

The Shopper Worth Index elevated 0.2% in July, coming in proper at expectations. On a yearly foundation, the CPI rose 2.9%, its lowest yearly progress charge since March of 2021 (and barely beneath expectations of three%). Equally, core CPI inflation, which leaves out unstable meals and vitality costs, rose 0.2% in July, additionally at expectations. On a yearly foundation, core CPI was up 3.2%, its lowest yearly charge since April of 2021.

For extra particulars on a right this moment’s launch, try CEA’s X thread.

As featured in a current speech by CEA Chair Jared Bernstein, inflation is within the midst of a round-trip. Initially, inflation took off when robust client demand shifted shortly from in-person companies in direction of items on the similar time that provide chains confronted unprecedented, pandemic-induced disruptions. In reality, as proven on this new paper by Federal Reserve economists, inflation took off at about the identical time and the identical tempo in most superior economies (see their Determine 1). As provide chains unsnarled and demand cooled, disinflation took maintain and, whereas its path has not been linear, inflation has been steadily drifting again right down to pre-pandemic charges.

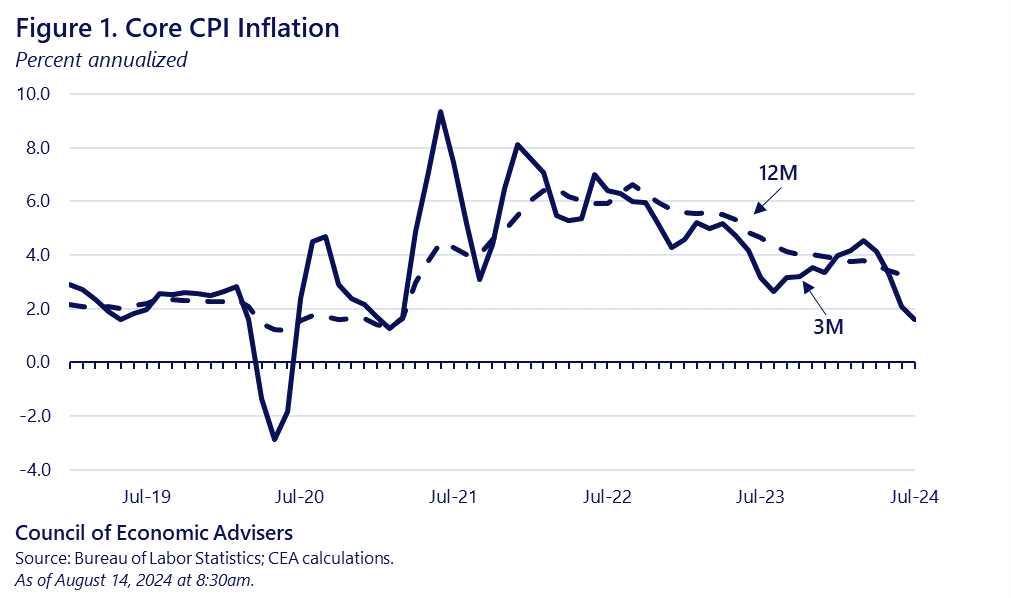

Whereas the round-trip shouldn’t be full and there’s extra work to be completed, knowledge from the previous 12 months reveal a downward development in inflation that continued in July. Determine 1 plots 12-month and 3-month annualized modifications in core CPI. The three-month measure captures extra of inflation’s ups and downs since 2023, together with the interval through the first few months of this 12 months when disinflation paused, however each sequence present that easing inflation is again on observe.

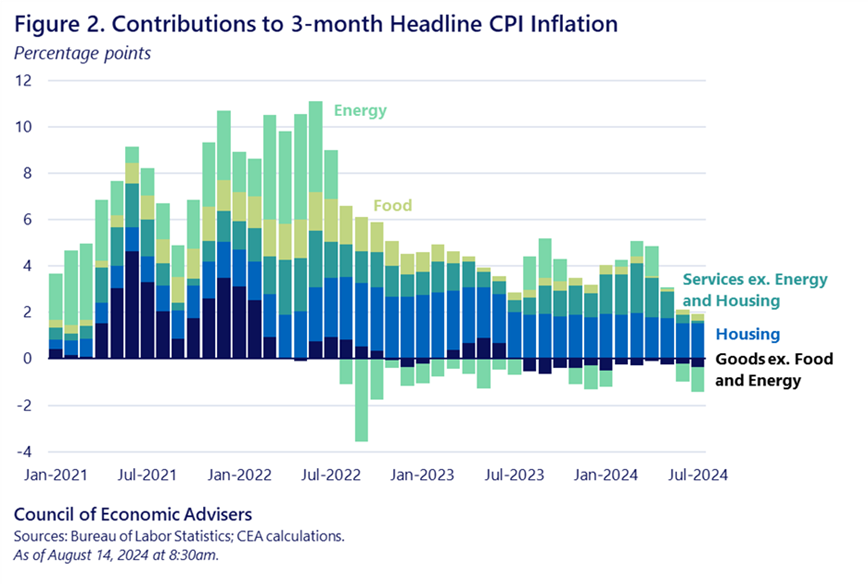

The following determine sticks with the 3-month annualized progress charges, however breaks out inflation’s primary parts, together with housing, vitality, meals, core companies (companies excluding housing and vitality), and core items (items excluding meals and vitality). We focus on every in flip.

Core items: The determine clearly exhibits the pandemic dynamics mentioned above. Items inflation was a significant contributor to the rise within the CPI again in 2021, however been a detrimental contributor since July 2023. Thus far this 12 months, core items costs have decreased 0.9%.

Meals: Meals inflation was 0.2% in July and has additionally eased considerably from its peak. That is significantly the case for grocery costs, which ticked up 0.1% in July and 1.1% over the previous 12 months (groceries comprise about 8 % of all purchases for the typical family and 11 % for these within the lowest-income quintile). Persistent cooling in grocery inflation marks the continuation of a welcome development that CEA has been observing. The three-month annualized % change in grocery costs has remained beneath headline CPI inflation since March 2023.

Restaurant costs have been significantly stickier, up 4.1% on a yearly foundation. Even that charge, nevertheless, is lower than half of the 8.8% inflation charge for eating places in March of final 12 months.

Vitality: The worth of vitality, particularly retail fuel, has been one other essential supply of disinflation, or on this case, deflation. Over the previous 12 months, the fuel worth included within the CPI is down 2.2%. Knowledge from AAA present that over the previous 12 months, the typical worth for a gallon of fuel fell from $3.85 to $3.44 as of August thirteenth, or $0.41 much less per gallon. Word that over this similar interval, the typical hourly wage for middle-wage staff went up (in nominal phrases) from $29.03 to $30.14, or $1.09. In different phrases, an hour of labor right this moment buys extra fuel than it did a 12 months in the past because of the mixture of each rising pay and falling fuel costs.

Housing: Actions in housing costs have contributed much less to inflation’s round-trip than the above classes, although they’ve helped. At its peak in February 2023, housing added 2.8 proportion factors to three-month headline CPI inflation. By December 2023, this contribution was a full proportion level decrease. After an uptick within the first quarter of this 12 months, housing’s contribution to three-month annualized headline inflation has declined every month from April by way of July, and July noticed the bottom contribution since October 2021.

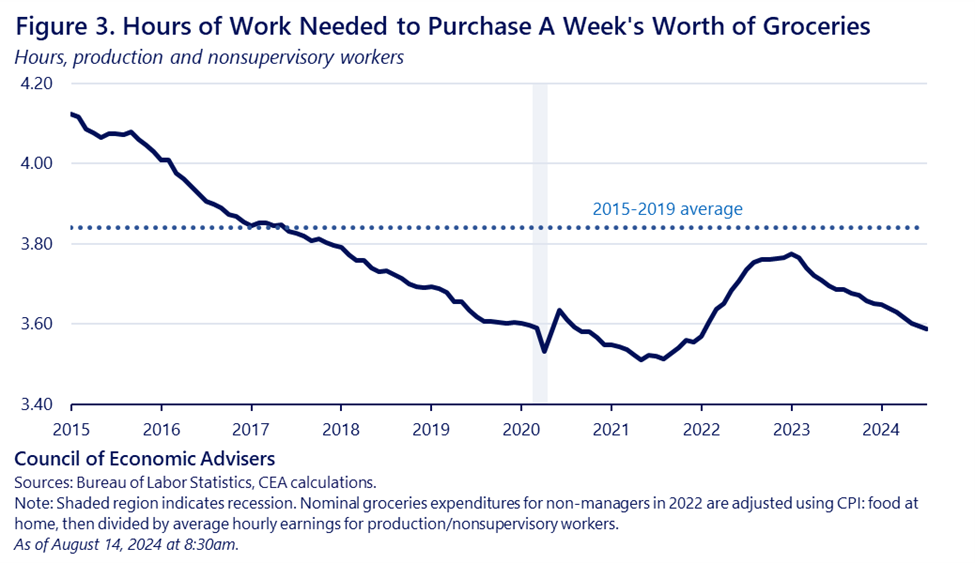

Whereas inflation’s continued descent from its roundtrip is clearly a constructive improvement, it isn’t at all times obvious what all these numbers imply to households making an attempt to make ends meet. As a concrete instance of how these dynamics assist in that endeavor, it’s helpful to show again to grocery costs and in addition, as we did with retail fuel above, add in the advantages of rising pay. The determine beneath exhibits the variety of hours of labor it takes for the typical, middle-wage employee to afford per week’s price of groceries.

Collectively, rising wages and falling grocery inflation have restored buying energy for grocery buyers to pre-pandemic ranges. That’s, it takes this employee the identical quantity of labor to purchase a bag of groceries because it did earlier than the pandemic took maintain and inflation took flight.

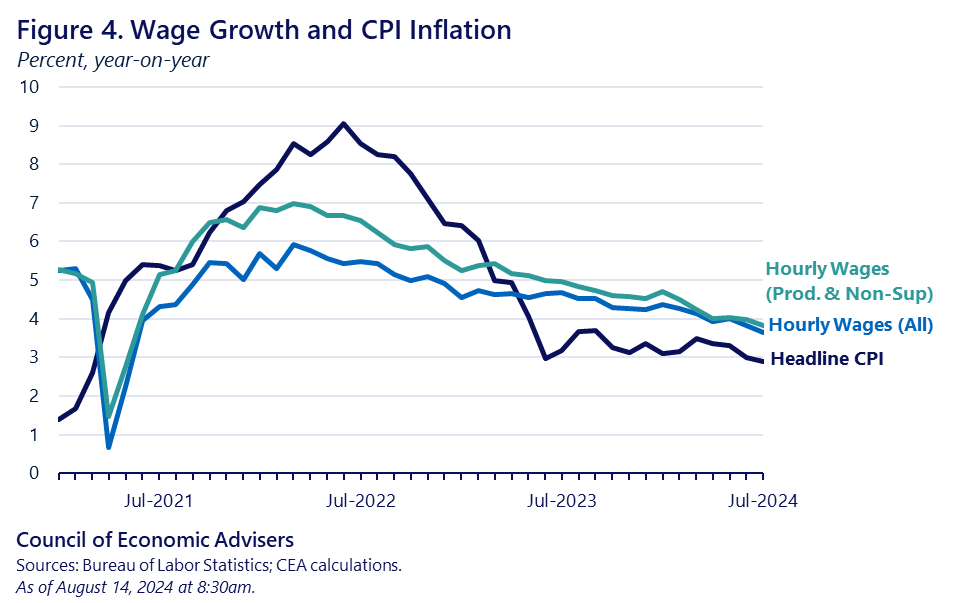

Extra broadly, as this final determine exhibits, yearly hourly wage progress has been outpacing worth progress for 15 months, and for 17 months amongst middle-wage staff.

None of those favorable tendencies imply our work is over. Too many households nonetheless face costs which can be too excessive, and we’ll proceed our aggressive agenda to decrease the prices of well being care, prescribed drugs, housing, youngster care, and lots of different sources of stress to household budgets. However the mixture of easing inflation because it continues on its roundtrip, together with rising pay, helps to raise households’ shopping for energy, and we plan to proceed to construct on that progress.