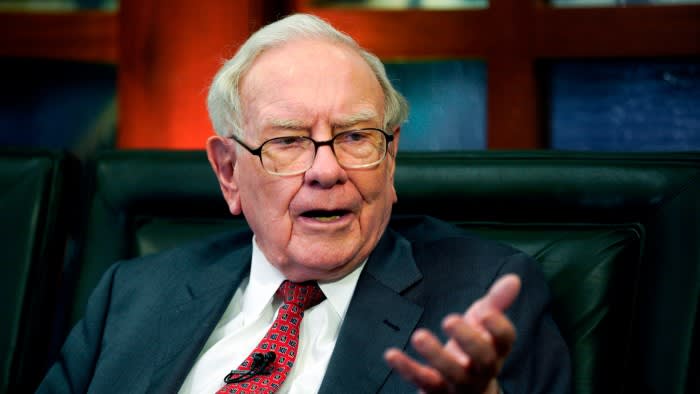

Berkshire Hathaway has quietly constructed a $6.7bn place in New York-listed Chubb, one of many world’s greatest insurance coverage corporations, highlighting Warren Buffett’s continued curiosity in monetary providers, based on regulatory filings printed on Wednesday.

Buffett’s conglomerate had been amassing a big minority stake in Chubb since final yr, however regulators allowed Berkshire to maintain the place confidential. The submitting mirrored its stake in Chubb as of March 31, having purchased up 6.4 per cent of its excellent share capital.

The insurance coverage group has ridden a wave of rising industrial insurance coverage costs that has despatched its market worth develop by three-quarters previously 5 years to greater than $100bn, placing it right into a small membership of mega-cap insurers that features Germany’s Allianz and China Life.

Information of the stake despatched Chubb’s fill up 9 per cent by pre-market buying and selling on Thursday.

Berkshire’s money pile has swelled this yr as Buffett has trimmed his stakes in shares equivalent to Apple which have traditionally buoyed his portfolio. Its money place hit a report $189bn within the first quarter.

Institutional funding managers within the US that handle greater than $100mn should report their holdings in regulatory filings. However they’ll request “confidential therapy” to omit sure positions.

Berkshire requested that exemption for a minimum of one in every of its shares in regulatory filings final yr, which have since been amended to incorporate its stake in Chubb.

Chubb — which supplies merchandise equivalent to residence, automotive and legal responsibility insurance coverage — is headed by chief government Evan Greenberg, who remodeled the group when he struck the most important deal in property and casualty insurance coverage historical past again in 2015, reversing Zurich-based Ace into New York-listed Chubb. Immediately, the corporate employs about 40,000 individuals throughout greater than 50 international locations and territories.

Greenberg is the son of US insurance coverage business veteran Maurice “Hank” Greenberg, whose decades-long tenure at rival AIG made that group the world’s greatest insurer for a time.

Lately, bets on insurance coverage have introduced their very own set of dangers. Pure catastrophes have created enormous losses for property insurers, exacerbated by inflation, whereas Chubb, as an example, is likely one of the insurers on the hook for the collapse of Baltimore’s Key Bridge in March.

It’s anticipated to ship a $350mn fee to the US state of Maryland inside weeks, though the corporate will in the end solely be answerable for a portion of that payout.

Berkshire, which just lately held its annual assembly, has been promoting greater than shopping for currently as Buffett has struggled to search out worthwhile investments at a time when the S&P 500 index is constantly hitting new highs on the again of sturdy financial information.

The revelation of Berkshire’s stake in Chubb comes because the conglomerate braces for a post-Buffett period. On the firm’s annual assembly this month, Buffett laid out a sweeping function for Greg Abel, who could have the ultimate choice on the agency’s investments.

Insurance coverage is a big a part of the group below Berkshire government Ajit Jain, together with vital reinsurance operations and automotive insurer Geico. Buffett, referred to as the Oracle of Omaha, has additionally been a longtime investor within the monetary providers sector, having stakes in world funds supplier Mastercard and Financial institution of America.

Further reporting by Ian Smith