New York

CNN

—

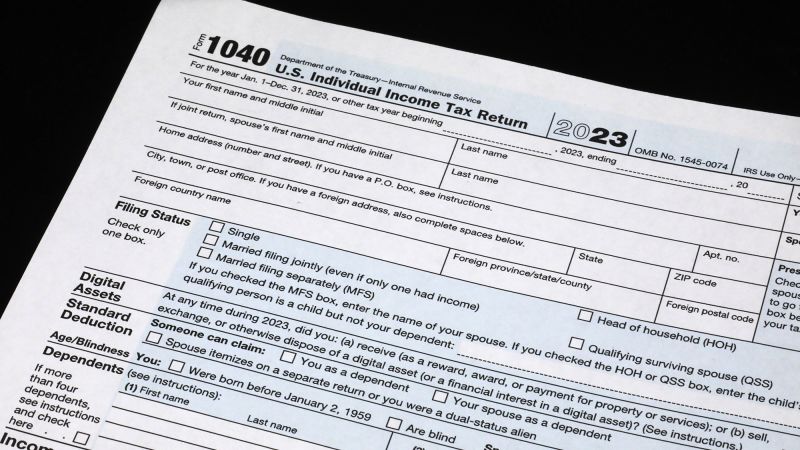

It’s Tax Day in america for many People, and there are nonetheless loads of individuals racing to file their 2023 revenue tax returns up till the clock strikes midnight.

“With the April deadline upon us, we’re seeing a flurry of tax returns coming in through the ultimate hours. We’ve already obtained greater than 100 million [returns] and tens of thousands and thousands extra returns are being filed within the ultimate days,” IRS Commissioner Danny Werfel advised reporters on Friday.

So for those who’re a last-minute filer, you’re in good firm — and much more so for those who anticipate a refund. Werfel famous that the company has already paid out greater than $200 billion in refunds by means of early April. Total, two in three filers are owed a refund, he stated.

Right here are some last-minute notes and ideas that can assist you in your down-to-the-wire quest to file your federal return or to get an extension to file with out incurring monetary penalties. (Examine your state’s tax income division web site to see what to be conscious of when doing the identical to your state return.)

At this time might not be your precise submitting deadline: Sure, April 15 is the large kahuna of tax-filing deadlines for most individuals. However thousands and thousands of People don’t must file as we speak as a result of they’ve been granted computerized extensions if, for example, they reside or do enterprise in a federally declared catastrophe space or had been affected by the October 7 Hamas assault on Israel. Or in the event that they reside in Massachusetts and Maine, which observe Patriots Day on April 15, or Washington, DC, which marks Emancipation Day on April 16. People residing overseas robotically get a further two months to file, till June 15. Nevertheless, they need to pay no matter they nonetheless owe the IRS for tax 12 months 2023 by April 15. Members of the US navy stationed overseas additionally get that two-month extension, plus they could qualify for different extensions – together with extensions to pay – if they’re in a fight zone.

File for an computerized extension: Can’t get your act collectively in time to file your type 1040 by 11:59 pm tonight? Then request an computerized six-month extension by filling out this way, which can push your submitting deadline to October 15, 2024. Werfel estimates 19 million last-minute filers can be doing so.

With out that extension, for those who merely file late and you continue to owe cash to the IRS, you can be hit with a failure-to-file penalty plus curiosity in your excellent stability.

Pay what you owe as we speak, or not less than a few of it: Even for those who safe an extension to file, most individuals are required to pay no matter they nonetheless owe the IRS for tax 12 months 2023 by April 15.

So do your greatest to estimate what that quantity can be and ship in your fee — or not less than a partial fee — tonight. Making a fee will provide help to keep away from, or restrict, the failure-to-pay penalty and curiosity you can be charged in your stability due. (Listed here are some ideas for tips on how to estimate what you continue to owe for those who’re not submitting a accomplished return but.)

If that stability is unmanageable for you, there are alternatives to work out a fee plan with the IRS to cut back your penalties and curiosity, which in any other case can compound shortly.

Double test your work: To stop any delays within the processing of your return (or refund for those who’re owed one), and to keep away from any headache-inducing interactions with the IRS after you file, be sure you’re getting the fundamentals proper in your return.

Additionally be sure you reply the digital property query on the primary web page of your 1040 and that you just file the proper kinds wanted if, in actual fact, you had any taxable transactions with cryptocurrencies like bitcoin.

As an example, test that the next are appropriate: the spelling of your title, your deal with, your submitting standing, your Social Safety quantity and your checking account quantity for those who’re looking for direct deposit for a refund. Additionally double test your computations. Do all this even for those who relied on a tax program or tax skilled to organize your return.

(Listed here are different last-minute ideas and assets you should utilize from the IRS for those who need assistance, have questions or wish to file at no cost.)

Monitor your refund: In the event you’re among the many majority of tax filers due a refund and also you haven’t obtained it but, you may observe its standing through the use of the IRS The place’s My Refund? device on-line.

The typical refund as of early April was $3,011, up $123 from a 12 months in the past. The turnaround time for the IRS to ship them out might be quick.

“The IRS has achieved an ideal job of getting refunds out shortly this 12 months. … In lots of circumstances individuals have been getting refunds in simply over every week. That’s essential as a result of for many individuals, these are the largest checks they see all of the 12 months,” Werfel stated.

(On the lookout for some concepts for tips on how to put your refund to good use? Listed here are a number of.)